lhdn e filing contact number

Apply for PIN Number. Get 100 correct PCB calculations every time.

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Actpay is approved by LHDN.

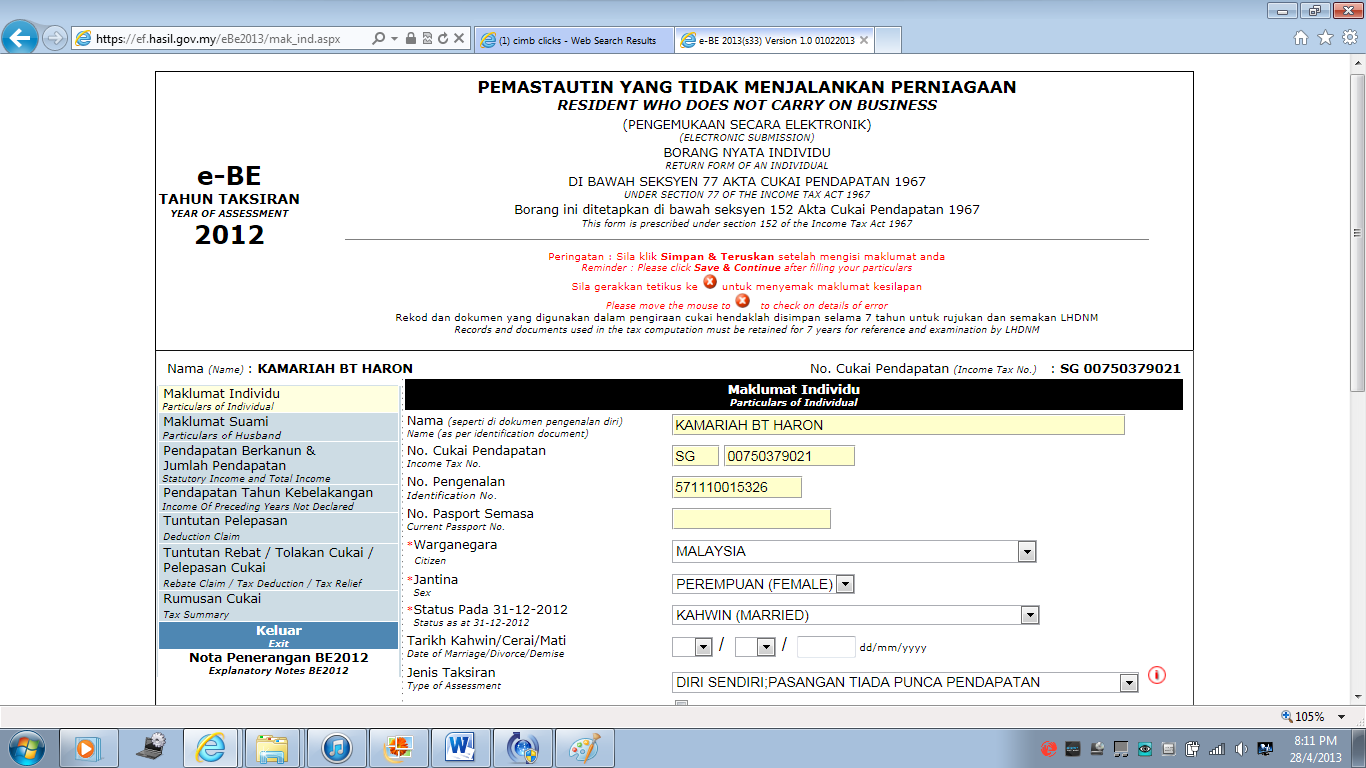

. Form BE Income tax return for individual who only received employment income Deadline. Then scan your IC in PDF format. This accurate payroll software is also known to help small to large companies avoid penalties from filing incorrect taxes.

You can view your application status via CIMBs Application Status Checker here by entering your IC Number and Application Number only applicable for online application submission. Scroll to the bottom and click. CP38 deduction or CP38 form is an IRB guideline for employers.

SOCSO LHDN EIS HRDF EPF Borang A SOCSO Borang 8A Income Tax CP39 and Borang E ready. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. The accounting treatment on the effects of changes in foreign exchange rates has been outlined in MFRS 121 which is equivalent to IAS 21The Malaysian Inland Revenue Board LHDN has issued a revised Guidelines on tax treatment related to the implementation of MFRS 121 on 16 May 2019 and subsequently issued a Public Ruling PR 122019 on the tax treatment of.

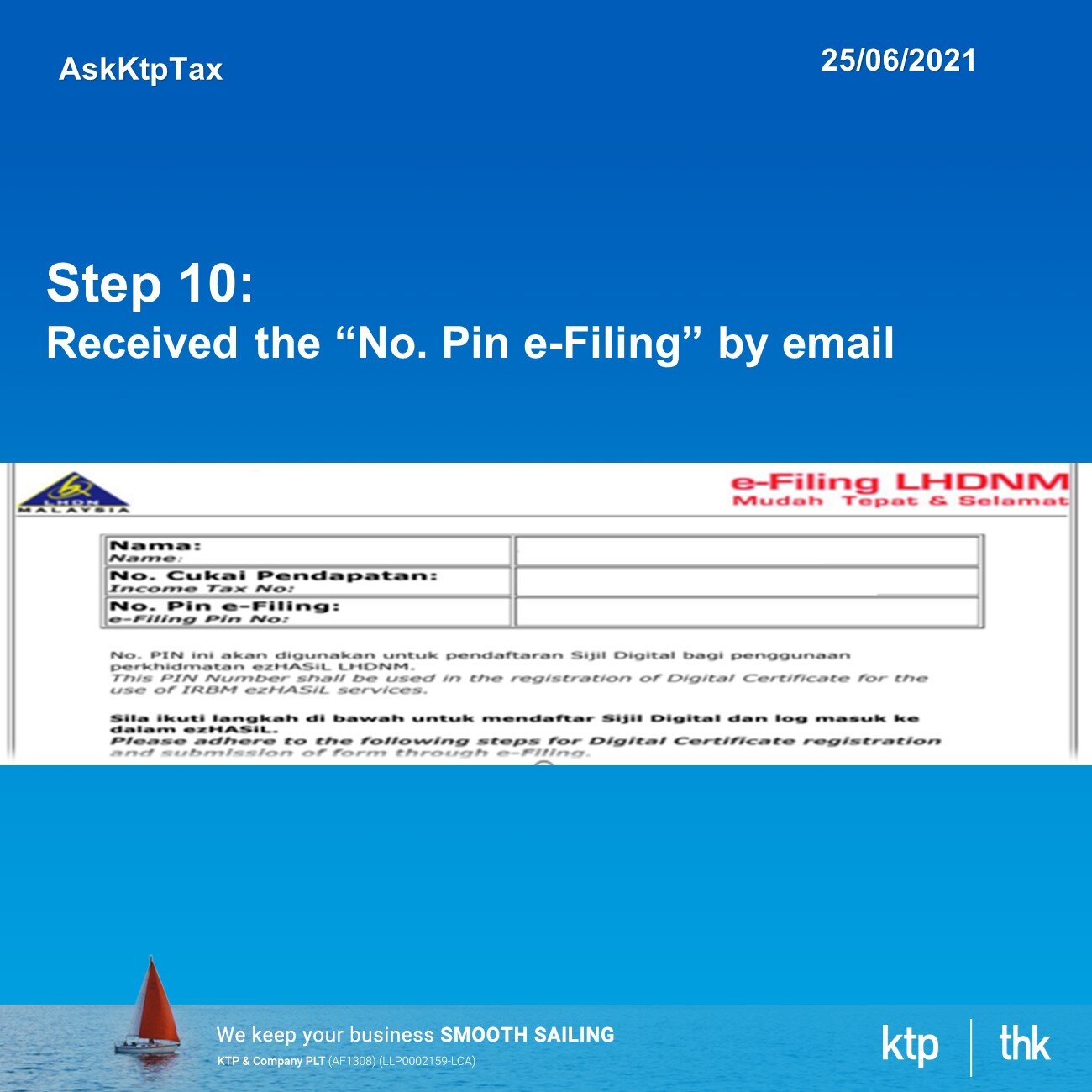

If you email address not registered with LHDN you have to fill up Online Feedback Form to obtain PIN Number. Then click on e-Filing PIN Number Application. Even with more than one kids tax relief of husband and wife is still capped at RM8000 each.

When using PCB or EPF table the estimated monthly tax amount is deducted from your salary. Click on Application and then e-Filing PIN Number Application at the left menu. Select Accounts Banking then select Bill Payment.

1 Accounting Software in Malaysia We empower more than 600000 accounting and business professionals using SQL Account and SQL Payroll to perform their daily operation effectively. While making tax payment through various tax payment options taxpayers have to specify a few information such as Name of TaxpayerEmployer Income tax numberEmployer number Identity number and Payment Code. These are the steps to fill up e-Filing online through the ezHASiL portal.

The IRB has discovered that you have committed tax fraud. 31032022 30042022 for e-filing 4. Download Form CP55D and fill in the required information.

Thus since May 11 2020 if you buy a new zero-emissions car ie. The Best Accounting Software trusted by more than 250000 companies. Return Form RF Filing Programme.

E - Janji Temu. 30042022 15052022 for e-filing 5. Visit ezHASiL and go to the website menu Customer Feedback.

SSPN tax relief is RM8000 per year until assessment year 2022 ie. You can get it from the nearest LHDN branch office or apply online via the LHDN Customer Feedback website. Apply for PIN Number Login for First Time.

Ranked at 24 th in 2018 World Banks Ease of Doing Business Malaysia is fast gaining traction as one of the favourite investment destinations to do business in Malaysia and building a business in Malaysia. EA form is used for the filing of personal taxes during tax season. One with an engine powered by electricity or hydrogen leads to a purchase discount of 8000.

How to make a LHDN payment. For accurate calculation of EPF contribution rate the bonus tax of employees you need to enter the monthly salary of employees even if the Bonus is paid on a different day. Form CP500 LHDN can be revised by completing the Form CP502 and send it to the respective LHDN Branch before 30 June for the current year of assessment.

Plus it has reliable software updates that can assure your firms compliance with the latest employment and tax legislation. Latest 1-month salary slip 6-month salary slip for commission earner Latest 1-month bank statement Latest EPF statement or Latest BE Form full submission to LHDN Latest 6-month bank statement Business Registration Certificate Form 9 24 49. In case of separate filing husband and wife can claim RM8000 of tax relief each meaning total RM16000 of tax relief for a family.

And employers must follow these instructions. On the other hand the Luxembourg. How to fill up e-Filing for first timers.

A Complete Guide to Start A Business in Malaysia 2022. For new hybrid vehicles electric and fossil-fuel with emissions less than or equal to 50g of CO2km the discount awarded totals 2500. Call CIMBs Consumer Contact Centre at 603 6204 7788.

Payment code is referring to the type of tax that categorized by Inland Revenue Board IRB or Lembaga Hasil Dalam Negeri LHDN Malaysia. After your document is. If your email address registered with LHDN browse to ezHASiL e-Filing website and click PIN Number Application.

Heres how you can apply for your PIN number online. Your employer pays this amount to the LHDN by the 10th of each month. Though the high ranking in the World Banks Ease of Doing Business signifies that starting a business in.

Select the Form CP55D and complete the pdf form. DOCUMENTS FOR STANDARD CHARTERED CREDIT CARD APPLICATION Salaried Employee. For the individual that did not receive the Form CP500 LHDN they can visit or call LHDN Branch that handles the file or call the Hasil Care Line at 1-800-88-5436.

Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. We are the Number 1 accounting software in South East Asia use by. SQL Payroll software is ready to use with minimal setup for all companies.

Otherwise a claim will be brought against the employer. There are 4 methods on how to obtain a PIN Number. Form E Form used by company to declare employees status and their salary details to LHDN Deadline.

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Lhdn Extends E Filing Deadline To June 2020 Also Applies To Manual Submission Lowyat Net

How To File Your Taxes For The First Time

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To File Your Taxes For The First Time

Premier Account Services Home Facebook

How To Step By Step Income Tax E Filing Guide Imoney

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Clpc Advisors Clpc My Due To Further Extension Of Mco Lhdn Issued 2020 Filing Program Dated 28 4 2020 To Further Extend The Corporate Tax Form C Submission Deadline 2 Month Extension For

Step By Step Income Tax E Filing Guide

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

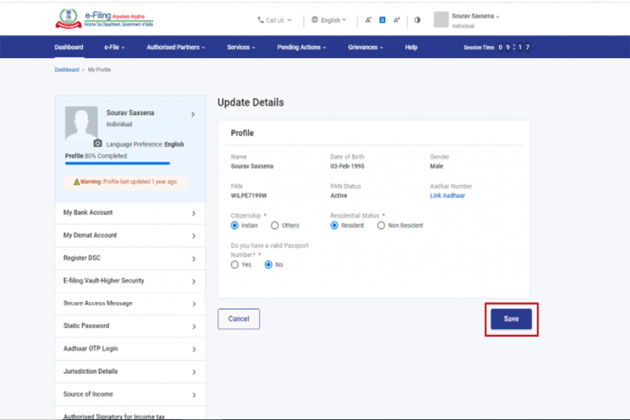

Itr Portal Profile Update How To Update Your Profile Details On The New Income Tax Portal

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Comments

Post a Comment